Beyond the “Cheap” Reputation

The Chinese tire industry has undergone a dramatic transformation in the past five years. What was once synonymous with budget-only, compromised quality has evolved into a sophisticated manufacturing ecosystem competing head-to-head with European and Japanese brands on innovation, durability, and performance.

This evolution is tangible. ZC Rubber, China’s largest tire manufacturer and the 9th globally, now produces 55 million units annually and holds OEM partnerships with major automakers. Linglong, with 30 million units per year, supplies original equipment tires to Volkswagen, General Motors, and Ford. Triangle, ranked 10th worldwide, manufactures 22 million tires annually, with advanced testing centers in Weihai, Germany, and Ohio. These are not boutique manufacturers-they are industrial powerhouses serving the same quality-conscious clients as Michelin and Continental.

The critical question has shifted from “Are they safe?” to “Are they worth the trade-offs for my use case?” This distinction matters because the answer is contextual.

Market Shift: How Manufacturers Are Competing Globally

Chinese tire makers are no longer competing primarily on price. Instead, they’re investing heavily in R&D, international certifications, and brand positioning. Sailun has secured TÜV SÜD certification, confirming compliance with European standards for rolling resistance, wet grip, and high-speed durability. Linglong received Responsible Supply Chain Initiative (RSCI) certification from an association founded by Daimler, Volkswagen, and BMW-the first and only tire manufacturer to achieve this distinction.

Updated Chinese certification standards (GB 9743-2024 and GB 9744-2024), effective May 1, 2025, introduce stricter performance requirements including rolling resistance and wet grip testing aligned with international norms. This regulatory shift signals that Chinese manufacturers are raising the floor across the entire industry.

Quick Summary Box: Who Should Buy Chinese Tires?

| Green Light (Strong Fit) | Yellow Light (Consider Alternatives) | Red Light (Avoid) |

|---|---|---|

| City commuters (<15,000 km/year) | Mixed urban + highway (50/50 split) | High-performance sports driving |

| Second family vehicle | Cold climate with seasonal changes | Extreme weather (heavy snow/ice without specialized tires) |

| Budget constraints (< $400/set) | Long-distance highway hauling | Track use or aggressive driving |

| Newly licensed drivers | Vehicles requiring niche sizes | Heavy towing or commercial use |

| Mild climate regions | – | – |

Core Cluster 1: Are Chinese Tires Safe? Quality, Safety & Regulations

Regulatory Compliance: How Safety Standards Actually Work

When tires are sold in regulated markets-the EU, North America, Kazakhstan, Russia-they must meet specific safety certification requirements. This is critical to understand: a Chinese tire sold in Europe must meet identical EU safety standards as a Michelin or Pirelli tire sold in the same market.

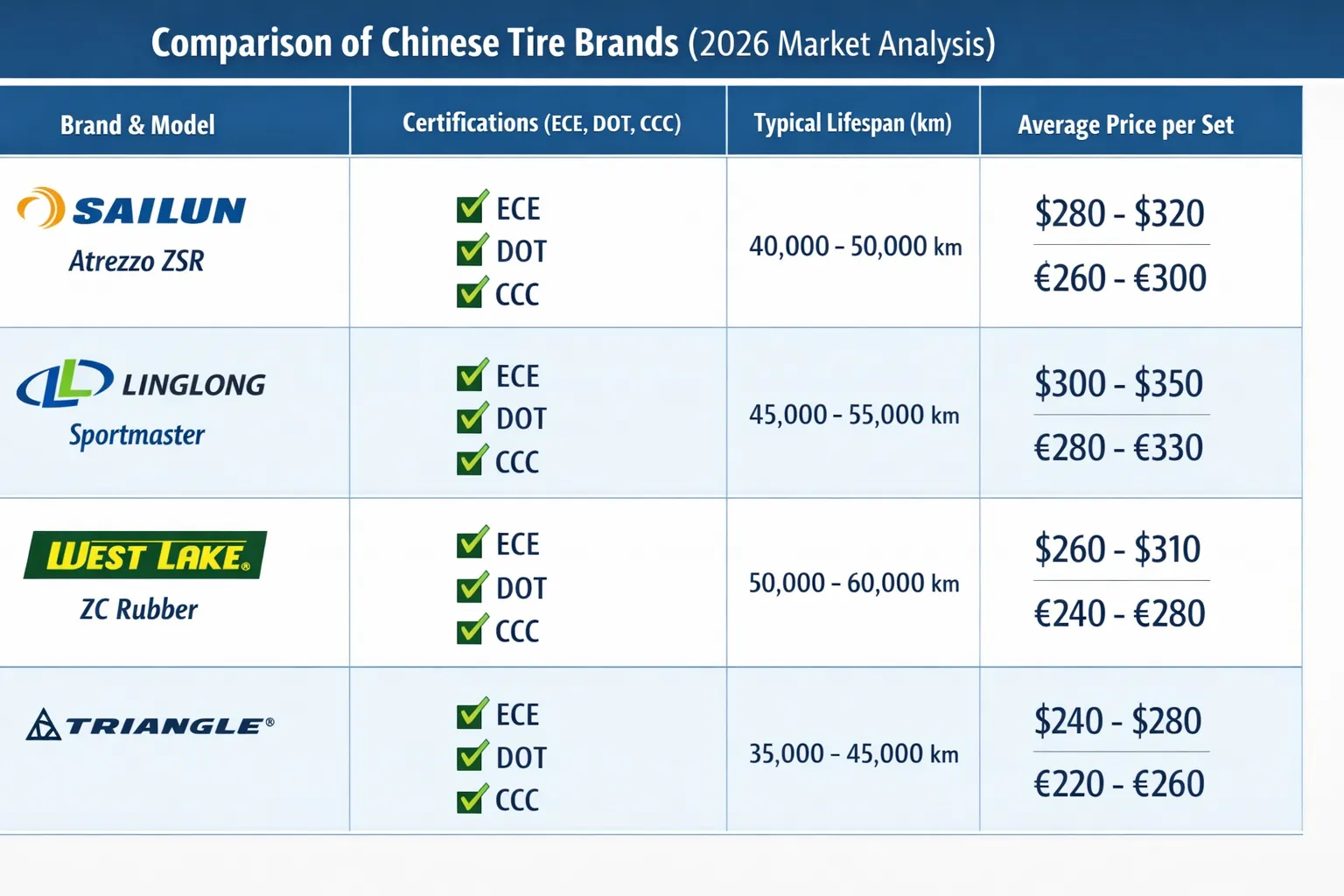

Chinese tires entering Europe require ECE (Economic Commission for Europe) certification, which mandates testing for rolling resistance, wet grip performance, external rolling noise, and high-speed durability. Tires marketed in North America undergo DOT (Department of Transportation) testing. Tires sold in China itself require CCC (China Compulsory Certification) under the updated 2024 standards.

This means:

- A Linglong tire on a European VW assembly line has passed the identical wet-grip tests as a Continental tire

- Sailun tires with TÜV SÜD certification have been independently verified against German safety standards

- ZC Rubber’s brands hold SmartWay certification, confirming rolling resistance and environmental compliance for North American markets

However, certification alone does not determine real-world performance. Compliance ensures a tire meets minimum thresholds; it doesn’t reflect the engineering refinement that premium brands invest in.

Performance Reality Check: Pros and Cons

Pros: What Chinese Tires Do Well

Adequate Traction for Daily Driving. Leading Chinese brands deliver traction sufficient for normal city and highway driving. Sailun’s Atrezzo ZSR, tested by independent reviewers across 46 real-world user evaluations, achieved a 72% satisfaction rating with particular praise for dry grip and value perception. ADAC’s 2025 all-season tire test found the Chinese budget brand Aplus competitive on ice braking and fuel economy, outperforming several more expensive alternatives on cost-per-kilometer driven.

Certified Safety Features. Modern Chinese tires incorporate wide circumferential grooves for hydroplaning resistance, high-density siping for wet-weather biting edges, and reinforced sidewall protection. These are industry-standard features, not premium innovations.

Comfort for Daily Use. City-speed driving (typically under 100 km/h) benefits from the simpler, softer rubber compounds Chinese manufacturers use. This translates to a smoother, more cushioned ride compared to some European performance tires tuned for highway feedback.

Strong Value Geometry. For a driver covering 10,000 km annually in mild climate conditions, the mathematics favor Chinese tires significantly. A $400 Chinese tire set that lasts 50,000 km costs $0.008 per kilometer-versus a $900 premium tire set lasting 80,000 km at $0.011 per kilometer.

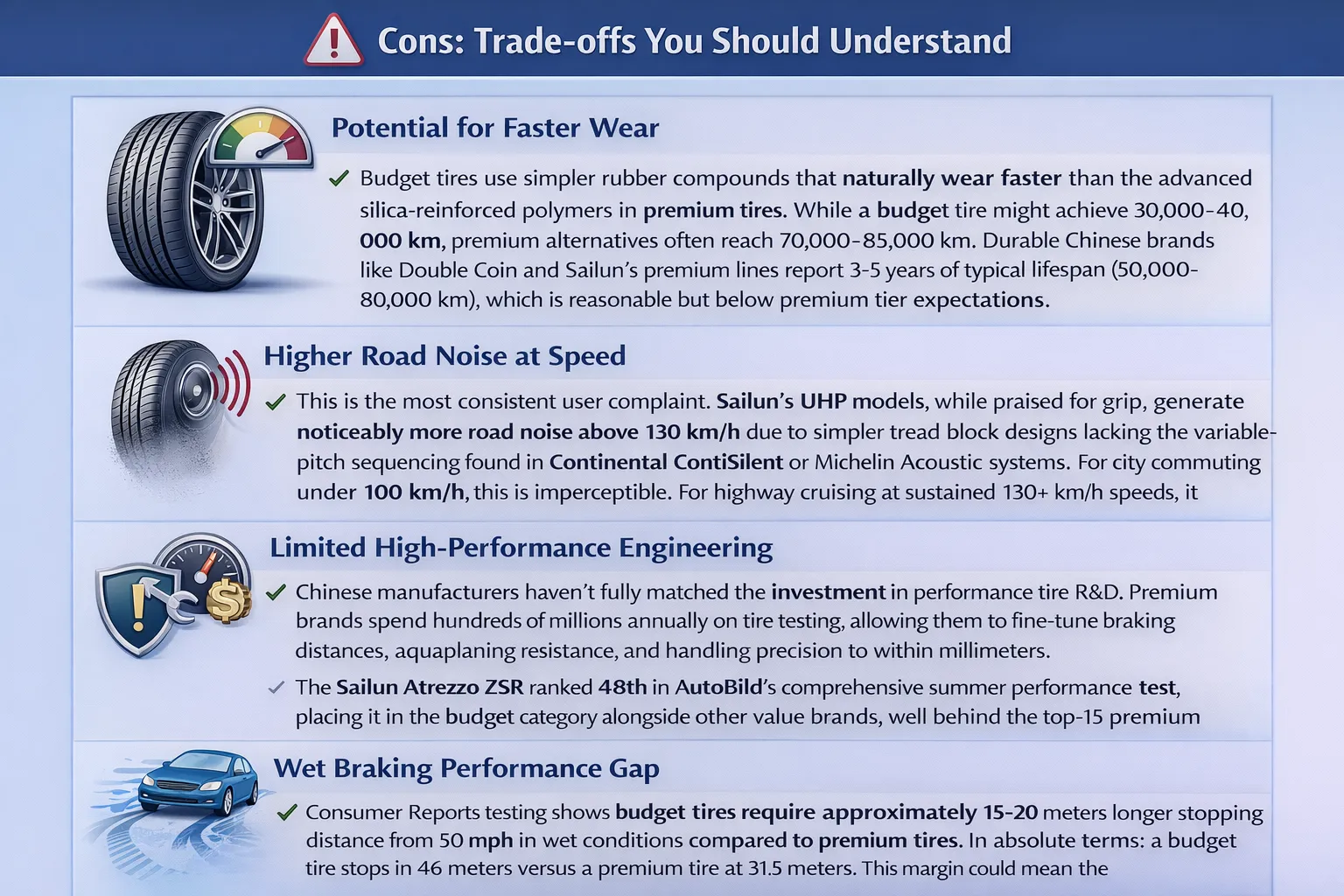

Cons: Trade-offs You Should Understand

Potential for Faster Wear. Budget tires use simpler rubber compounds that naturally wear faster than the advanced silica-reinforced polymers in premium tires. While a budget tire might achieve 30,000-40,000 km, premium alternatives often reach 70,000-85,000 km. Durable Chinese brands like Double Coin and Sailun’s premium lines report 3-5 years of typical lifespan (50,000-80,000 km), which is reasonable but below premium tier expectations.

Higher Road Noise at Speed. This is the most consistent user complaint. Sailun’s UHP models, while praised for grip, generate noticeably more road noise above 130 km/h due to simpler tread block designs lacking the variable-pitch sequencing found in Continental ContiSilent or Michelin Acoustic systems. For city commuting under 100 km/h, this is imperceptible. For highway cruising at sustained 130+ km/h speeds, it becomes noticeable.

Limited High-Performance Engineering. Chinese manufacturers haven’t fully matched the investment in performance tire R&D. Premium brands spend hundreds of millions annually on tire testing, allowing them to fine-tune braking distances, aquaplaning resistance, and handling precision to within millimeters. The Sailun Atrezzo ZSR ranked 48th in AutoBild’s comprehensive summer performance test, placing it in the budget category alongside other value brands, well behind the top-15 premium performers.

Less Comprehensive Warranty Coverage. Budget Chinese tires typically offer limited or no treadwear warranties, while premium brands guarantee 40,000-80,000 miles with road hazard protection. This gap is significant if a defect emerges after 20,000 km.

Wet Braking Performance Gap. Consumer Reports testing shows budget tires require approximately 15-20 meters longer stopping distance from 50 mph in wet conditions compared to premium tires. In absolute terms: a budget tire stops in 46 meters versus a premium tire at 31.5 meters. This margin could mean the difference between avoiding a collision and experiencing one in emergency braking scenarios.

Core Cluster 2: Top Brand Reviews & Comparisons

Leading Chinese Tire Manufacturers

| Brand | Best For | Key Models | Certifications | OEM Partnerships | Annual Output |

|---|---|---|---|---|---|

| Sailun | Budget UHP & Performance | Atrezzo ZSR, Atrezzo ZSR2 | TÜV SÜD, DOT, ECE | Growing (aftermarket focus) | 20M+ units |

| ZC Rubber (Westlake/Goodride/Chaoyang) | All-rounder Quality | Westlake Gen II, Goodride lines | SmartWay, DOT, ECE, ISO 16949 | Major OEM contracts | 55M+ units |

| Linglong | Comfort & Traction | Sportmaster series, 4S line | ECE, DOT, ISO, CCC, RSCI | VW, GM, Ford | 30M+ units |

| Triangle | Commercial & Specialty | TH201, TR968, TR653 | ECE, ISO, ISO/TS 16949 | OEM supplier | 22M+ units |

| Aplus | Economy All-Season | A702, A701, A909 | CCC, ECE | Limited OEM | 10M+ units |

| Aeolus, Double Coin, Sportrak | Niche Segments | Varies by line | Regional certifications | Growing | 5M-15M each |

In-Depth Brand Profiles

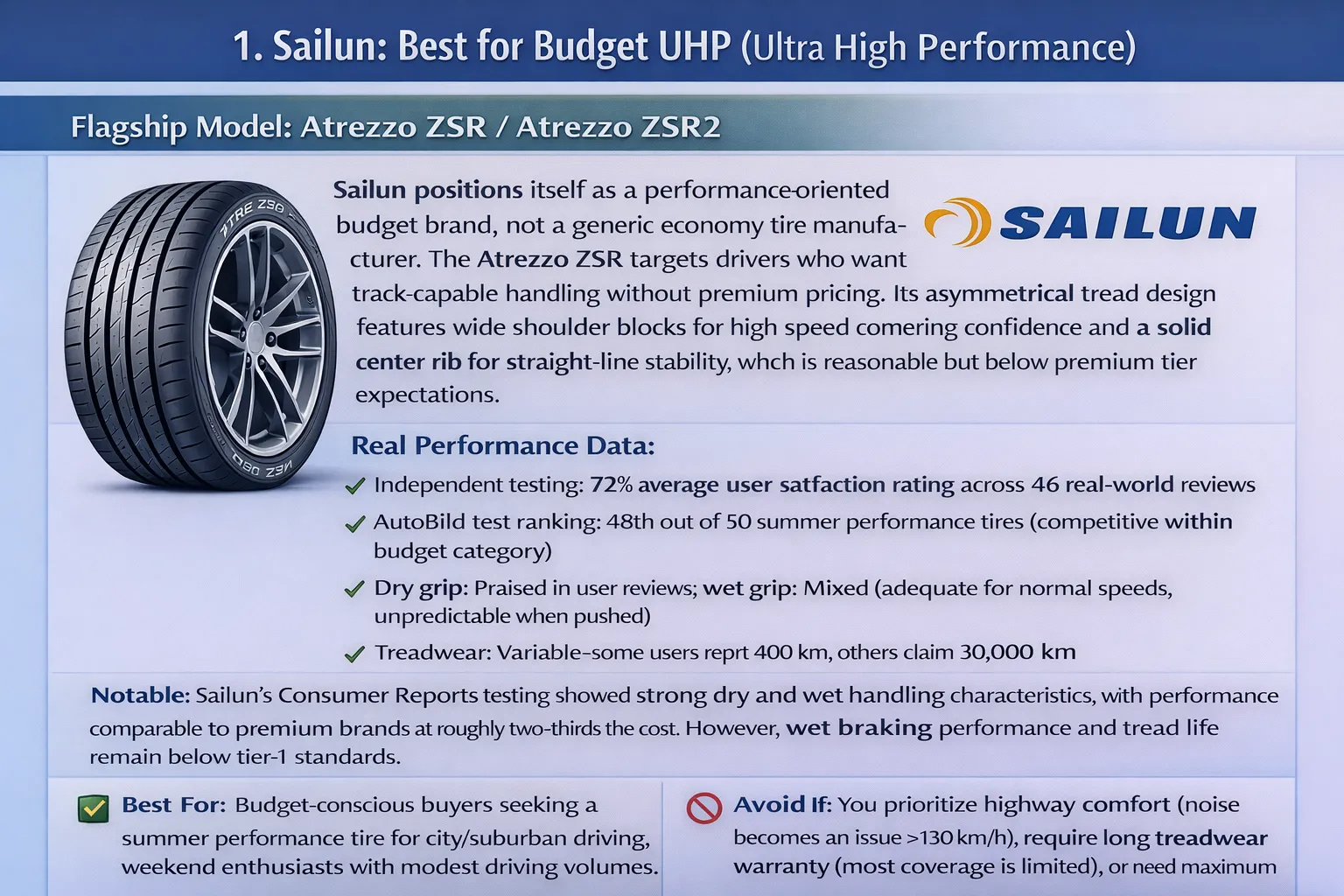

1. Sailun: Best for Budget UHP (Ultra High Performance)

Flagship Model: Atrezzo ZSR / Atrezzo ZSR2

Sailun positions itself as a performance-oriented budget brand, not a generic economy tire manufacturer. The Atrezzo ZSR targets drivers who want track-capable handling without premium pricing. Its asymmetrical tread design features wide shoulder blocks for high-speed cornering confidence and a solid center rib for straight-line stability.

Real Performance Data:

- Independent testing: 72% average user satisfaction rating across 46 real-world reviews

- AutoBild test ranking: 48th out of 50 summer performance tires (competitive within budget category)

- Dry grip: Praised in user reviews; wet grip: Mixed (adequate for normal speeds, unpredictable when pushed)

- Treadwear: Variable-some users report 40,000 km, others claim 30,000 km

Notable: Sailun’s Consumer Reports testing showed strong dry and wet handling characteristics, with performance comparable to premium brands at roughly two-thirds the cost. However, wet braking performance and tread life remain below tier-1 standards.

Best For: Budget-conscious buyers seeking a summer performance tire for city/suburban driving, weekend enthusiasts with modest driving volumes, drivers in dry climates.

Avoid If: You prioritize highway comfort (noise becomes an issue >130 km/h), require long treadwear warranty (most coverage is limited), or need maximum wet-weather safety margin.

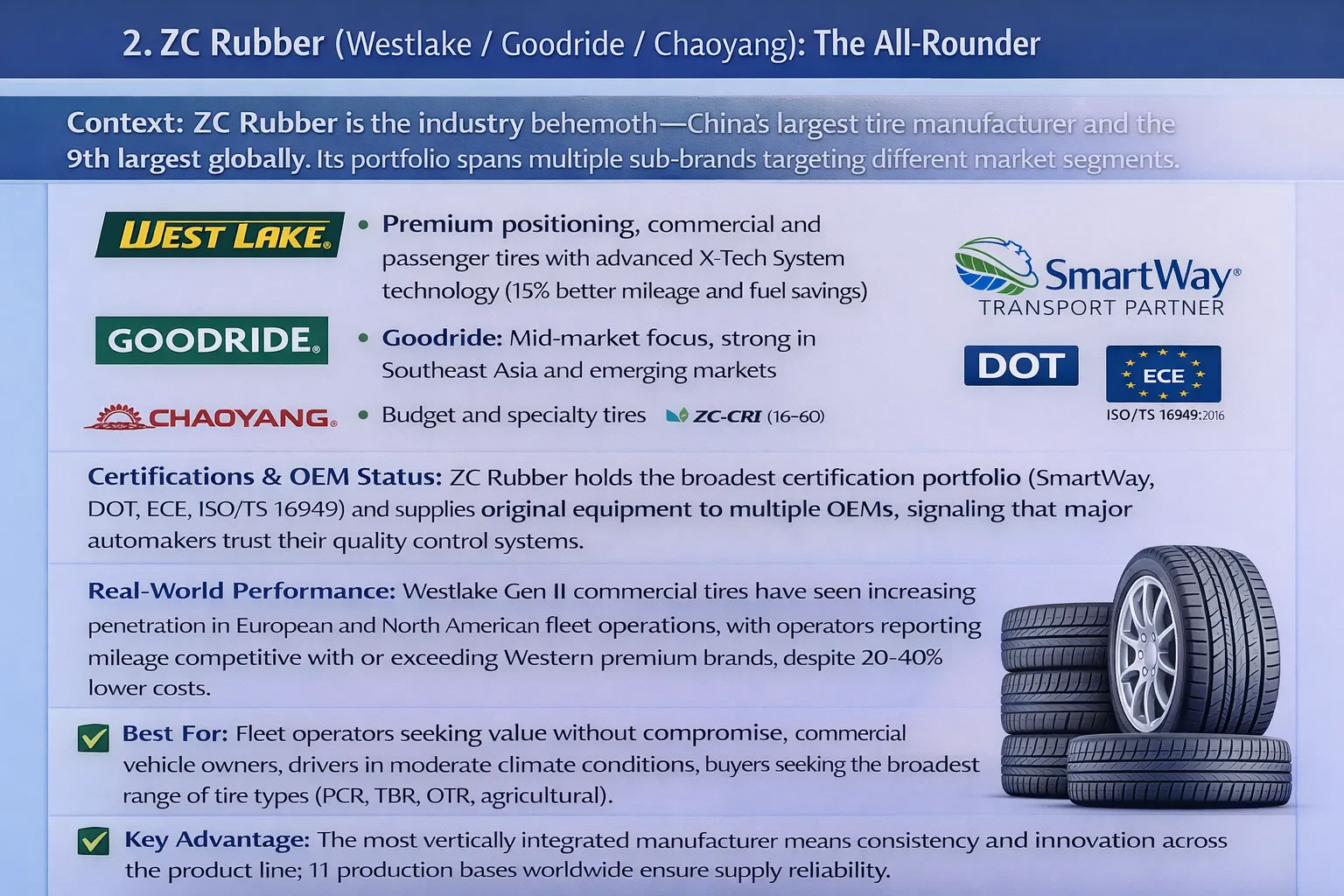

2. ZC Rubber (Westlake / Goodride / Chaoyang): The All-Rounder

Context: ZC Rubber is the industry behemoth-China’s largest tire manufacturer and the 9th largest globally. Its portfolio spans multiple sub-brands targeting different market segments.

- Westlake: Premium positioning, commercial and passenger tires with advanced X-Tech System technology (15% better mileage and fuel savings)

- Goodride: Mid-market focus, strong in Southeast Asia and emerging markets

- Chaoyang: Budget and specialty tires

Certifications & OEM Status: ZC Rubber holds the broadest certification portfolio (SmartWay, DOT, ECE, ISO/TS 16949) and supplies original equipment to multiple OEMs, signaling that major automakers trust their quality control systems.

Real-World Performance: Westlake Gen II commercial tires have seen increasing penetration in European and North American fleet operations, with operators reporting mileage competitive with or exceeding Western premium brands, despite 20-40% lower costs.

Best For: Fleet operators seeking value without compromise, commercial vehicle owners, drivers in moderate climate conditions, buyers seeking the broadest range of tire types (PCR, TBR, OTR, agricultural).

Key Advantage: The most vertically integrated manufacturer means consistency and innovation across the product line; 11 production bases worldwide ensure supply reliability.

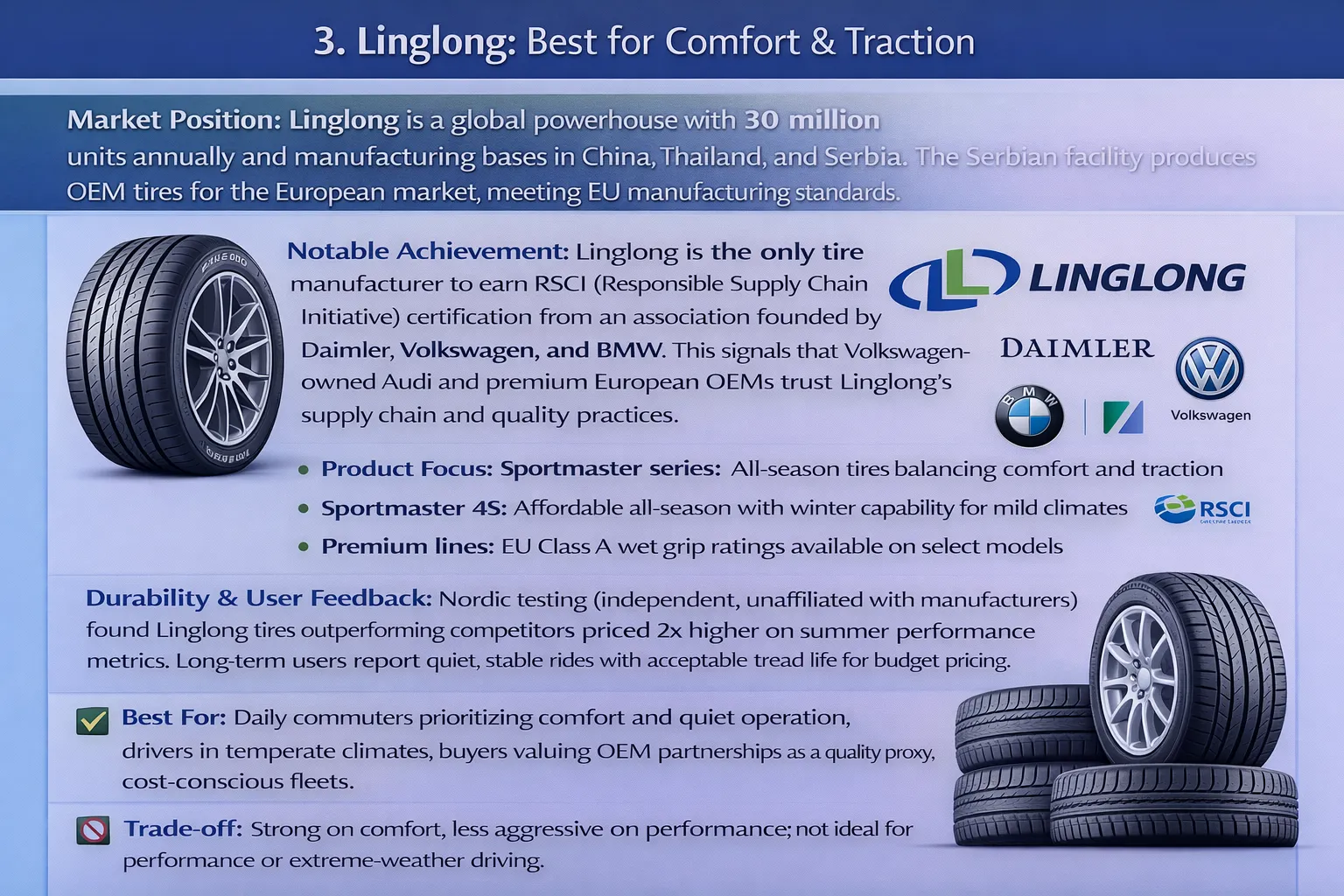

3. Linglong: Best for Comfort & Traction

Market Position: Linglong is a global powerhouse with 30 million units annually and manufacturing bases in China, Thailand, and Serbia. The Serbian facility produces OEM tires for the European market, meeting EU manufacturing standards.

Notable Achievement: Linglong is the only tire manufacturer to earn RSCI (Responsible Supply Chain Initiative) certification from an association founded by Daimler, Volkswagen, and BMW. This signals that Volkswagen-owned Audi and premium European OEMs trust Linglong’s supply chain and quality practices.

Product Focus:

- Sportmaster series: All-season tires balancing comfort and traction

- Sportmaster 4S: Affordable all-season with winter capability for mild climates

- Premium lines: EU Class A wet grip ratings available on select models

Durability & User Feedback: Nordic testing (independent, unaffiliated with manufacturers) found Linglong tires outperforming competitors priced 2x higher on summer performance metrics. Long-term users report quiet, stable rides with acceptable tread life for budget pricing.

Best For: Daily commuters prioritizing comfort and quiet operation, drivers in temperate climates, buyers valuing OEM partnerships as a quality proxy, cost-conscious fleets.

Trade-off: Strong on comfort, less aggressive on performance; not ideal for performance or extreme-weather driving.

4. Triangle: Best for Commercial & Special Terrain

Market Position: Triangle Tire Co. Ltd. is the 10th largest tire manufacturer globally, producing 22 million units annually. Unlike other Chinese brands that started with passenger cars, Triangle built its reputation in commercial and specialty tires (agricultural, OTR, truck tires).

Innovation: Triangle has research centers in Weihai (China), Germany, and Akron (Ohio), with investment in smart tire technology and proprietary tread patterns developed using computer-integrated manufacturing systems.

Key Models:

- TR968: Ultra-high-performance summer tire with optimized high-speed stability

- TH201: Passenger car tire emphasizing safety and comfort

- TR653: Specialty trailer tire with dual-belt design for towing stability

- Commercial/OTR lines: Heavy-duty tires for demanding applications

Market Reality: Triangle has secured OEM partnerships with major automakers, indicating strict quality and safety standards compliance. Budget reviews consistently praise the brand for mixing performance and comfort with strong value.

Best For: Commercial vehicle owners, specialty tire applications (trailers, agriculture, off-road), buyers needing robust construction and durability, fleet operators with diverse tire needs.

Honorable Mentions: Other Competitive Chinese Brands

| Brand | Strengths | Best Segment |

|---|---|---|

| Aplus | Competitive on ice/wet; excellent fuel economy; exceptional cost-per-km | Budget all-season; winter driving in mild climates |

| Aeolus | Growing OEM partnerships; decent performance range | Mid-range daily drivers |

| Double Coin | Superior wear resistance; strong in hot climates | Commercial; Middle East/African markets |

| Sportrak | Performance-oriented; niche enthusiast following | Performance summer tires |

| Dynamo | Budget-friendly; emerging market focus | Economy segment |

Note: Brands like Aplus received competitive ratings in ADAC’s 2025 all-season tire test, ranking among the best for cost-per-kilometer despite a “Fair” overall rating due to specific wet-road performance gaps.

Core Cluster 3: Economics & Price Analysis

Price vs. Value: The Math Behind the Savings

The 15% Savings Rule (Actually, It’s 20-40%)

Chinese tires don’t just cost 15% less-they typically cost 20-40% less than comparable premium brands at equivalent performance levels.

Real Pricing Example:

- Premium: Michelin Pilot Sport 4S, 225/45R17 = ~$850 per set

- Mid-Range: Hankook Ventus S1 Evo3, 225/45R17 = ~$480 per set

- Chinese Budget: Sailun Atrezzo ZSR, 225/45R17 = ~$320 per set

- Savings Margin: 62% less than premium, 33% less than mid-range

This pricing disparity stems from labor cost differences (Chinese manufacturing wages are 30-40% of European levels), access to raw materials (China supplies natural rubber at lower input costs), and manufacturing efficiency gains from modern automated factories.

Long-Term Cost of Ownership: The Real Comparison

The initial savings shrink when you calculate total cost of ownership because durability matters.

Scenario A: Low-Mileage City Driver (10,000 km/year for 5 years = 50,000 km total)

| Tire Category | Set Cost | Expected Lifespan | Sets Needed | Total Cost | Cost/km | Cost/year |

|---|---|---|---|---|---|---|

| Premium (Michelin) | $900 | 80,000 km | 1 set | $900 | $0.0113 | $180/year |

| Budget Chinese | $400 | 50,000 km | 2 sets (+ replacement) | $850 | $0.017 | $170/year |

| Winner | – | – | – | Budget (slight edge) | Budget (by ~$30/year) | – |

Insight: For low-mileage drivers, the math is nearly identical when you account for replacement frequency. Chinese tires can actually win or draw on cost-per-kilometer.

Scenario B: High-Mileage Highway Driver (25,000 km/year for 5 years = 125,000 km total)

| Tire Category | Set Cost | Expected Lifespan | Sets Needed | Total Cost | Cost/km | Cost/year |

|---|---|---|---|---|---|---|

| Premium (Michelin) | $900 | 80,000 km | 2 sets | $1,800 | $0.0144 | $360/year |

| Budget Chinese | $400 | 50,000 km | 3 sets | $1,200 | $0.0096 | $240/year |

| Winner | – | – | – | Budget (saves $600) | Budget (by $0.0048/km) | Budget (by $120/year) |

Insight: For high-mileage drivers, the gap widens further in budget’s favor if you ignore safety and warranty factors. However, premium tires’ superior wet-braking performance and warranty coverage add non-monetary value that becomes critical for highway-heavy driving.

The Safety Premium: When Dollars Don’t Tell the Whole Story

This is where cost-per-kilometer analysis breaks down.

In wet braking from 50 mph, a premium tire stops in 31.5 meters versus a budget tire at 46 meters-a difference of 14.5 meters (roughly 50 feet). At highway speeds, this distance could represent the difference between:

- A near-miss and a collision

- Avoiding a hazard and hitting it

- Controlling your vehicle and losing it

You cannot buy that safety margin at budget pricing. This is why Consumer Reports, Tire Review, and professional testers consistently recommend premium tires for high-mileage or highway-heavy drivers despite the cost premium.

Positioning: The Economic Segment

Chinese tires occupy the “Lowest Economic Segment” of the market-below mid-range brands like Hankook or Nexen, above cheap unbranded tires. They represent the rational choice for a specific buyer profile: cost-conscious, low-mileage, urban-focused, risk-tolerant drivers. They are not the choice for safety-first families or high-mileage professionals.

Buying Guide: When to Choose Chinese Tires

Green Light: Strong Cases for Chinese Tires

✅ Daily city commuting (< 100 km/day): Urban speeds minimize noise issues and reduce braking performance gaps. A city commuter encounters few scenarios where the 14.5-meter wet-braking gap becomes life-threatening.

✅ Second family vehicle or older cars: Lower initial investment matches lower-value vehicles. Replacement costs are less painful. You’re comfortable with shorter tire lifespan because the vehicle itself is transitional.

✅ Budget constraints and financial prioritization: If a $400 tire set is the difference between affording new tires and driving on threadbare rubber, Chinese tires are the responsible choice. Safety at 50% of premium cost beats unsafe tires at 80% of premium cost.

✅ Low annual mileage (< 10,000 km): The math works in budget’s favor. You’re unlikely to experience the compounding durability issues that emerge with high-mileage driving.

✅ Mild climate regions (temperate, dry): Extreme winter or heavy rain pushes you toward premium tires’ superior wet/cold performance. Mild climates minimize stress on rubber compounds and tread patterns.

✅ Newly licensed or young drivers: Pairing a learning driver with a lower-cost tire investment reduces financial exposure if the vehicle is damaged. Once driving skills mature, upgrade to premium tires.

✅ Seasonal tire rotation (not year-round on same set): Seasonal switching reduces wear rate, extending lifespan beyond the typical 50,000 km budget baseline.

Yellow Light: Consider Alternatives

⚠️ Mixed urban + highway driving (50/50 split): You’ll face sustained highway speeds without the benefit of low-cost replacement (high mileage means you need durability). Mid-range brands like Hankook or Nexen offer better balance.

⚠️ Cold climates with winter requirements: Winter driving demands tread design sophistication. Premium winter tires from Nokian, Continental, or Bridgestone offer engineering that budget tires can’t match in sub-zero conditions.

⚠️ Long-distance highway hauling: Commercial drivers face liability, fuel economy impacts, and safety regulations that favor premium tire performance.

⚠️ Vehicles with niche tire sizes: Chinese manufacturers prioritize mainstream sizes (15-19 inches). If you drive a specialty vehicle requiring non-standard tire sizes, availability and pricing favor premium brands.

Red Light: Avoid Chinese Tires

🛑 High-performance sports driving: Performance driving demands precise steering feedback, high-speed cornering stability, and heat resistance that budget tires don’t deliver.

🛑 Extreme weather conditions (heavy snow/ice without specialized tires): Even specialized Chinese winter tires lag premium alternatives in extreme conditions.

🛑 Track use or amateur racing: Budget tires can’t withstand sustained high-speed stress or heat cycles.

🛑 Heavy towing or commercial fleet use: Liability, warranty, and performance requirements favor premium brands with proven commercial track records.

🛑 Vehicles you intend to keep for 10+ years: Over a decade, tire replacement costs compound. Premium tires’ longer lifespan means fewer total sets and lower long-term cost.

FAQ Section (Schema-Optimized)

Q: Do Chinese tires last as long as premium brands?

A: Generally, no. Chinese tires typically achieve 50,000-80,000 km of lifespan, while premium tires reach 70,000-85,000 km or more. However, the upfront savings (40-50%) often offset the shorter lifespan for low-mileage drivers. A budget tire lasting 50,000 km at $400/set can cost slightly less per kilometer than a $900 premium tire lasting 80,000 km-but this math only works for drivers covering fewer than 60,000 km over the tire’s life. For high-mileage drivers, premium tires’ longevity wins economically.

Durability Reality Check:

- Budget Chinese: 3-5 years or 50,000-80,000 km typical

- Premium brands: 5-7 years or 70,000-85,000 km typical

- Double Coin (Chinese premium line): Competitive longevity with Western brands in testing

Q: Which is the number one tire brand in China?

A: ZC Rubber (Zhongce Rubber Group), which owns Westlake, Goodride, Chaoyang, and other sub-brands. ZC Rubber is China’s largest tire manufacturer by volume and the 9th largest globally, producing over 55 million tires annually. It supplies original equipment to major automakers and operates 11 production bases worldwide. For value and market presence, Linglong is a close second with 30 million units annually and OEM partnerships with Volkswagen, GM, and Ford.

Q: Are Sailun tires noisy?

A: Some budget UHP models can produce noticeably more noise at high speeds (> 130 km/h) compared to tier-1 premium brands. This occurs because Sailun, like most budget manufacturers, doesn’t use acoustic foam insulation (ContiSilent, Michelin Acoustic) or variable-pitch tread sequencing found in premium tires.

However: Noise levels are acceptable for city driving under 100 km/h. Independent user reviews specifically praise Sailun for quietness on local roads. The noise issue emerges on sustained highway driving, particularly on concrete surfaces at cruising speeds above 130 km/h. If you’re primarily a city commuter, noise is a non-issue. If you’re a highway driver, this is a genuine trade-off.

Mitigation: Newer Sailun models (Atrezzo ZSR2) incorporate improved tread designs that reduce noise compared to earlier generations.

Q: Are Chinese tires sold in regulated markets (EU, US, KZ, Russia) actually safe?

A: Yes, when sold through authorized channels. Tires entering EU markets must pass ECE certification including wet grip, rolling resistance, noise, and durability testing using identical protocols applied to Continental, Michelin, and Pirelli tires. Tires entering US markets undergo DOT testing. Tires sold in Kazakhstan and Russia follow regional standards (GOST, CIS certifications).

The Critical Distinction: Certification ensures a tire meets minimum safety thresholds. It does not mean a Chinese tire performs identically to a premium tire. A certified budget tire is safe for normal driving conditions but has measurable performance gaps in emergency braking, extreme weather, and sustained high-speed scenarios.

Real-World Data: ADAC’s 2025 all-season tire test found budget Chinese tires (Aplus) competitive with mainstream brands on wet braking and ice grip, but noted that all budget options lack the emergency-response margin of premium tires. Safety is adequate for normal driving, not optimal for worst-case scenarios.

Q: What’s the wet weather performance difference between Chinese and premium tires?

A: Measurable and material. Consumer Reports testing documented:

- Wet braking distance: Budget 46m vs. Premium 31.5m (14.5m gap = 50 feet)

- Aquaplaning resistance: Premium tires maintain traction to 80.9 km/h; budget tires lose grip at lower speeds

- Wet handling precision: Premium tires offer predictable feedback; budget tires can feel less communicative

Context: At city speeds (50-80 km/h), this gap is noticeable but manageable. At highway speeds (100+ km/h) in rain, the gap becomes critical. This is why safety organizations recommend premium tires for highway-heavy driving.

Q: What should I do if I need tires but have a tight budget?

A: Tier your options:

- First choice: Seek mid-range brands (Hankook, Nexen, Falken) on promotion. These often cost only 20-30% more than Chinese budget tires while offering better durability and safety.

- Second choice: Chinese tires if you drive primarily in the city (< 100 km/day) and have low annual mileage (< 10,000 km).

- Third choice: Seek discounts on premium tires through warehouse club memberships or seasonal sales rather than buying new Chinese tires.

- Last choice: Used or retreaded tires only if you absolutely cannot afford new tires. Safety liability makes this risky.

Q: Do OEM partnerships validate Chinese tire quality?

A: Substantially. Volkswagen, General Motors, and Ford do not install sub-standard tires on new vehicles-they risk recalls, liability, and brand reputation damage. The fact that Linglong supplies OEM tires to these manufacturers suggests they pass the same stress testing and quality standards as established tire makers.

However: OEM tires are often engineered specifically for particular vehicles and aren’t necessarily the same as the consumer aftermarket versions of the same brand. A Linglong OEM tire for a VW Golf may differ from a Linglong consumer tire you buy separately.

The Real Verdict on Chinese Tires

Chinese tire manufacturers have evolved from budget-only suppliers to credible global competitors. Brands like ZC Rubber, Linglong, Sailun, and Triangle operate world-class manufacturing facilities, invest in R&D, and hold international certifications validating their commitment to safety and performance.

For the right driver, Chinese tires make financial and practical sense:

- Save 20-40% on upfront costs

- Achieve 50,000-80,000 km lifespan adequate for low-mileage urban drivers

- Meet international safety standards (when certified)

- Access a broad range of tire types and sizes

For drivers prioritizing maximum safety, longevity, and performance, premium brands remain the rational choice:

- 15+ meter advantage in wet braking

- 70,000-85,000+ km typical lifespan

- Superior handling precision and noise control

- Comprehensive warranty coverage

The verdict: Chinese tires are worth it if you’re a city commuter with low annual mileage, budget constraints, and tolerance for shorter lifespan and potential high-speed noise. They are not worth it if you drive highways frequently, live in extreme climates, or prioritize maximum safety margins. This isn’t a question of quality-it’s a question of matching product tier to driving reality.